When it comes to planning for the future and protecting our well-being, insurance plays a crucial role. Life insurance and health insurance are two essential types of coverage that offer distinct benefits to individuals and families. While both serve the purpose of providing financial security, they address different aspects of our lives. In this blog, we will explore the key differences between life insurance and health insurance, helping you make informed decisions about the type of coverage that best suits your needs.

1. Purpose and Coverage:

Life Insurance:

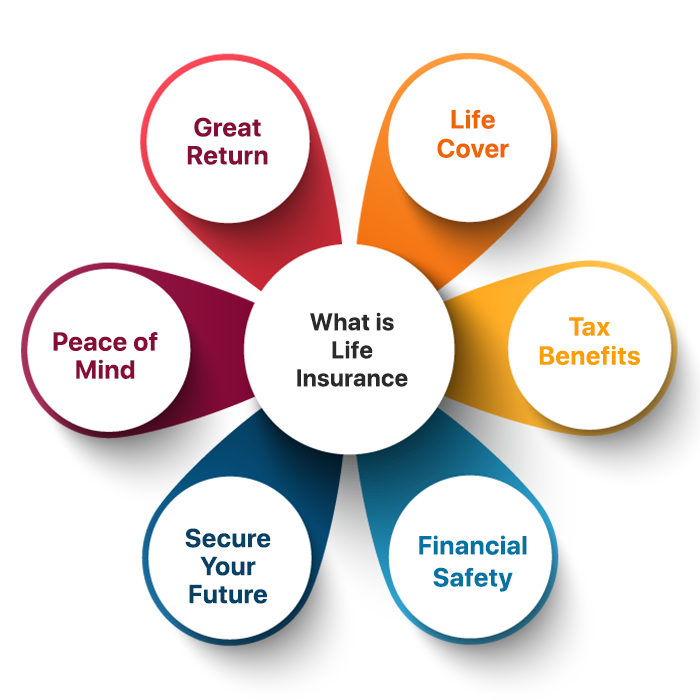

Life insurance is primarily designed to provide financial support to your beneficiaries in the event of your death. It offers a lump-sum payment, known as the death benefit, to your designated beneficiaries. This payment can be used to cover funeral expenses, pay off debts, replace lost income, and support your loved ones’ financial needs after your passing. Life insurance policies come in various types, such as term life, whole life, and universal life, each with its own features and benefits.

Health Insurance:

On the other hand, health insurance is intended to cover medical expenses and provide access to quality healthcare services. Health insurance policies pay for a portion or all of the medical costs, including doctor visits, hospitalization, prescription drugs, preventive care, and more. Health insurance ensures that you and your family can receive necessary medical attention without facing significant financial burdens.

2. Timing and Duration:

Life Insurance:

Life insurance policies typically provide coverage for a specified term or for the duration of your life, depending on the type of policy you choose. Term life insurance offers coverage for a specific number of years, such as 10, 20, or 30 years, while whole life and universal life insurance provide coverage for your entire life as long as the premiums are paid.

Health Insurance:

Health insurance, on the other hand, is usually provided on an annual basis and requires annual renewal. It covers medical expenses incurred during the policy period, and you need to maintain active coverage to avail the benefits.

3. Beneficiaries:

Life Insurance:

In life insurance, you designate beneficiaries who will receive the death benefit upon your passing. Beneficiaries can be individuals, such as your spouse, children, or other loved ones, or even organizations.

Health Insurance:

Health insurance does not have beneficiaries in the same sense as life insurance. Instead, it covers medical expenses for the policyholder and, if applicable, their covered dependents.

4. Usage of Benefits:

Life Insurance:

The death benefit from a life insurance policy is typically paid out in a lump sum to the beneficiaries. They have the freedom to use the funds as needed, such as paying off debts, funding education, or maintaining their standard of living.

Health Insurance:

Health insurance benefits are used to cover medical expenses directly related to the policyholder’s health and well-being. These expenses can include doctor visits, hospital stays, surgeries, prescription medications, and preventive care.

5. Cost and Premiums:

Life Insurance:

The cost of life insurance premiums is based on factors such as age, health condition, coverage amount, and the type of policy. Term life insurance tends to be more affordable in the early years, while whole life and universal life insurance premiums may be higher but offer lifelong coverage and potential cash value accumulation.

Health Insurance:

Health insurance premiums are typically paid on a monthly or annual basis and are based on factors like age, location, coverage level, and any pre-existing health conditions.

All in All;

In conclusion, life insurance and health insurance are both crucial components of a comprehensive financial plan. Life insurance provides financial protection for your loved ones in the event of your death, while health insurance ensures access to quality healthcare and protection against high medical expenses. Understanding the key differences between these two types of insurance will help you make informed decisions to safeguard yourself and your loved ones’ well-being in the face of life’s uncertainties.